About the Author

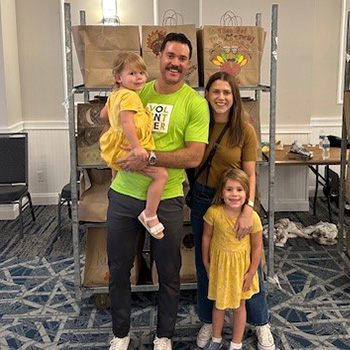

Living healthy (and wealthy) is a marathon, not a sprint. It requires decades of dedication, passion, and perhaps a little help to the finish line along the way. Troy Garcia, author of the Health and Wealth blog, is enthusiastic about sports — having had a career in high school and collegiate baseball — but it’s more than just the wins. This helped Troy learn the value of being a team player and staying strong until the game is won.

He brings this attitude to Health & Wealth, delivering insightful tips — from the perspective of a CFP® — fueled with a sporty edge. His goal is to help you pursue gains with your financial fitness and financial health (without losing focus on that one rep max or golf swing you’re working on!)

Get to the finish line of your financial life!

Popular Tags

Health & Wealth

A blog about personal and financial fitness by Troy Garcia CFP®,Financial Advisor