Contrary to Commentary E11

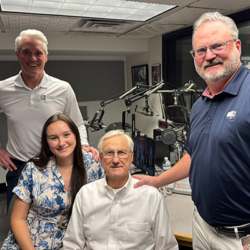

Hosted by:

Holland Henderson

Hosted by:

Chris Hammond

June, 2025

In this episode, we explore the controversial topic of elected officials trading stocks and shed light on pending legislation that could reshape these practices. As the dog days of summer settle in, we also explore how trust in both political and financial systems is essential for long-term stability. We tackle the unpredictable world of tariffs and their impact on global trade.

In this episode we cover:

- Information on trading that happens within our lawmakers and the Pelosi Tracker (4:00)

- The STOCK Act and what it stands for (6:21)

- The strategy of trading like Congress has been around for years (8:20)

- How the PELOSI Act will work in reality (10:00)

- What is a Blind Trust in the real world and how does it work (12:13)

- Ninety-seven percent of lawmakers traded in industries tied to the committee work they were in (16:48)

- The tariff conversation part 2 (21:34)

- The U.S. makes up twenty-five percent of the world’s GDP (30:59)

- What are the hosts learning now (39:12)

Links From the Show:

Allen & Company

The PELOSI Act

STOCK Act

Blind Trust

Hedge Fund

Connect with:

Holland Henderson – Financial Advisor at Allen & Company

Allen & Company – Holland Henderson

LinkedIn – Holland Henderson

Chris Hammond – CFA®, Senior Vice President, Portfolio Manager at Allen & Company

Allen & Company – Chris Hammond

LinkedIn – Chris Hammond

The opinions voiced in this program are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which strategies or investments may be suitable for you, consult an appropriate qualified professional prior to making a decision.