Social Security is a hotly debated topic, and we often get the question from clients: Will the Social Security Trust soon be empty with no assets to pay benefits when I retire?

Social Security is a hotly debated topic, and we often get the question from clients: Will the Social Security Trust soon be empty with no assets to pay benefits when I retire?

The Social Security system began as one of the core components of FDR’s “New Deal” during his presidency in the 1930s. The system, passed in 1935, at its inception was designed to pay retired workers over the age of 65 a continuing income after retirement. When FICA payroll taxes first began in 1937, they amounted only to a 1% tax on the first $3,000 in wages and salary.

After survivor and dependent benefits were added in 1939, the system remained largely unchanged until 1956, when early retirement benefits (62) were added. In 1972, an annual Cost-of-living-adjustment (COLA) was added by President Nixon.

As mentioned above, for its entire existence, Social Security has been funded by payroll taxes of working Americans. The current tax rate is 7.65% for employees AND employers, so a 15.3% total tax on payrolls.

With this common background, let’s dive into the status of Social Security and what is likely to come in the future. The most doomsday headlines over the last few years generally include something similar to “Social Security will run empty in 2034”. A scary thought!…however, it is only partially true.

Truth Serum

Truth Serum

Social Security is hugely popular among voters. The retirement age is likely to increase, and FICA taxes are likely to increase as well. However, wholesale changes to the system are unlikely.

For most of the last nine decades, the amount of payroll taxes has been significantly higher than the benefits paid, and as a result, there have been consistent surpluses in the Trust that administers the program. Unfortunately, instead of investing the surplus, which would’ve generated many times its original value over the decades, the government leaves the surplus in the Treasury’s general account, limiting the growth of funds. As a result, despite a 15.3% combined payroll tax rate, the Fund does stand to run short soon. BUT here is where the shades of grey are very important:

- Payroll taxes are STILL sufficient to cover roughly 75% of Social Security benefits (CBPP)

- If the Trust ran out of funds, instead of automatically reducing benefits, the gap would instead be added to the government deficit & still paid to retirees.

- There is still time to make simple tweaks to shore up the system.

So What Should Be Done?

So What Should Be Done?

The primary reason that a gap has formed between tax revenue and benefits is that the average life expectancy has grown significantly faster than the full retirement age. At the same time, the demographics of the country have grown older, meaning there are fewer people paying into the system for every retiree receiving benefits. Ultimately, I think a rational analysis of the system would determine the full retirement needs to be increased to balance the system.

Additional options that have been considered for balancing the system include:

- Reducing the COLA.

- Introducing “Means-Testing.”

- Increasing FICA taxes.

- Removing the income cap on FICA taxes.

Since saving and investing are our day-to-day business, I believe 15.6% in taxes should be MORE than enough to fund Social Security. Considering the benefit is capped, I also see no reason to remove the income cap to the tax, but it may be an eventuality that the cap on FICA taxes is removed.

Political 3rd Rail

Unfortunately, changing Social Security is not as simple as rational minds agreeing on the problem and implementing a solution. Recommending a change to entitlements, particularly Social Security, has proved to be political suicide for politicians, with the most recent example being Paul Ryan. Politicians catch heat even within their own party, as exemplified by Donald Trump attacking other Republican presidential suitors over recommendations to change the system. Washington is its own worst enemy when it comes to fixing Social Security.

So given the nature of politics, I don’t expect anything to be done on Social Security for a while. Both parties will let more time pass than they should and put a band-aid on the issue once it gets close, likely by using tax increases alongside changes to the retirement age for future retirees.

However, one thing should not be lost in this discussion: Social Security is wildly popular among voters. This means when push comes to shove, politicians will do what’s necessary to make sure it’s around for decades to come.

When It Matters

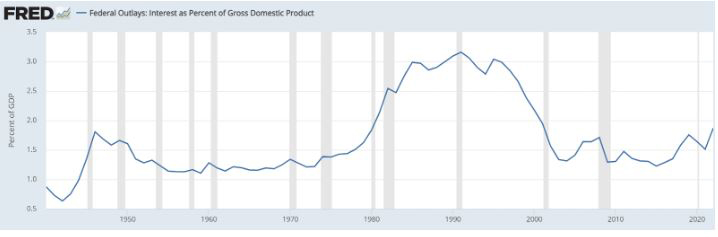

Given the likelihood of abrupt changes to social security benefits is relatively unlikely, what should we be most concerned about? In my opinion, the item to be concerned about is the risk of deficits in Social Security funding bleeding into the overall US Deficit. Although this may surprise some, the US Debt is not a massive issue for the country right now. Debt service to GDP is still manageable (pictured below). However, what creates the greatest risk is the government’s annual deficit AND the deficit’s growth rate. This is not sustainable long-term. We’ll unpack the debt in detail in a future edition of Contrary to Commentary, but IF Social Security drives deficits to grow in the future from today’s already elevated levels, it will likely prove to be a significant issue for the country long-term.

If you have questions regarding your Social Security, please contact my office to make an appointment.

September 2023

Truth Serum

Truth Serum So What Should Be Done?

So What Should Be Done?