Happy birthday, Dad!

My father would have turned 90 on February 6th of this year, but the passing of time and a couple of falls took him much too early in 2012. It’s always much too early when you cherish your parents, isn’t it? My dad was just the finest man I knew. Best gift a son could ever receive, that.

But in the spirit of full disclosure, I will tell you that once in my self-centered youth I confused Groundhog Day with Dad’s birthday… well, and then there was another year when I sent Mom a birthday card on Dad’s birthday. He just shook his head in a way that communicated: “It’s pitiful, but the boy tries.” This was a talent that would come in useful years later, when I had a son of my own.

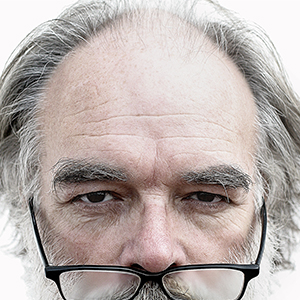

Reminders of aging… say goodbye to those locks

Last month I talked to you a bit about my own aging and turning 60. Those reminders of aging come on a regular basis. Just this past weekend, it was time to cut my hair. Let’s just say that the pitiful remnant of what my high school sweetheart called “luscious locks” back in the day is a sad site to behold, indeed.

I started cutting my own hair almost 20 years ago, and no… it wasn’t the price of haircuts that drove me to the DIY approach. (Even though it is another way to save money.) I simply didn’t have a lot of hair to work with anymore. Plus, I had to concede – unavoidably — that no one had ever stopped on the street to admire my hair… or my general good looks.

It was around last year I then realized any type of “haircut” was a ridiculous exercise in vanity. The top of my head was beginning to look like a harvested wheat field during a famine year.

Ever since, my definition of a “haircut” has meant an allover buzz at 1/8th inch in length, but now I am down to cutting (or mowing, as it were) my hair down to zero-fuzz length. Even more distressing: As my dome goes chrome, my eyebrows are beginning to resemble those of Pierre Salinger in his later years, but I digress. You must be asking by this point:

What the heck do haircuts have to do with financial planning?

Not much, I’ll grant you, but perhaps one nugget of financial knowledge inspired by this hair (or lack thereof) raising story:

All the planning in the world won’t keep all of life’s detours in check, including financial ones.

There are birthdays and death days — bald spots and wayward byways (and yes, up markets and down markets) — all of which we must contend with sooner or later. Trust me.

Pause to prepare for the financial future

So, in this time of stellar stock market returns, it’s a good time to take a breather. Appreciate the appreciation. Financial planning is crucial, but so is reflection. Perhaps most importantly: steel yourself for another day.

February 2018