Contrary to Commentary E13

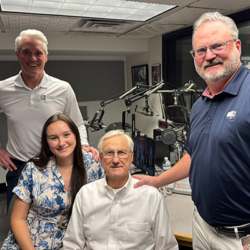

Hosted by:

Holland Henderson

Hosted by:

Chris Hammond

September, 2025

This episode opens discussing the pending new college football season and if you didn’t see that coming, this must be your first time listening. Next, Chris and Holland unpack the connection between Fed policies, interest rates, and mortgages, explaining how these forces shape everything from monthly payments to overall financial strategy.

In this episode we cover:

- Do investors want rates to decrease (11:23)

- Where can one hope the Fed will land (14:50)

- What if you have over-funded your emergency fund (17:45)

- Holland provides an update on the housing market (20:79)

- People owning a home can be an important part of financial planning (28:45)

- The math behind making extra payments on your mortgage (32:42)

- The average home in the US costs $365,000 and the average mortgage payment is $220 per month which takes an average income of $106,000 per year to afford (39:53)

- What are Holland and Chris learning right now (39:53)

Links From the Show:

Allen & Company

The Federal Reserve

Tariffs

A Tale of 2 Economies

Connect with:

Holland Henderson – Financial Advisor at Allen & Company

Allen & Company – Holland Henderson

LinkedIn – Holland Henderson

Chris Hammond – CFA®, Senior Vice President, Portfolio Manager at Allen & Company

Allen & Company – Chris Hammond

LinkedIn – Chris Hammond

The opinions voiced in this program are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which strategies or investments may be suitable for you, consult an appropriate qualified professional prior to making a decision.