I went to see “King Kong” a few weeks ago. It was a hoot…at least it was for me. I can remember how exciting it was to see the old 1933 version on our little black & white TV back around 1960. Given the reception we had, I thought it snowed on tropical islands until I finally made a trip to the Bahamas about 20 years later!

I went to see “King Kong” a few weeks ago. It was a hoot…at least it was for me. I can remember how exciting it was to see the old 1933 version on our little black & white TV back around 1960. Given the reception we had, I thought it snowed on tropical islands until I finally made a trip to the Bahamas about 20 years later!

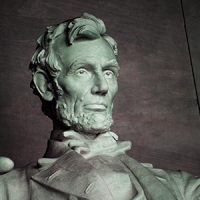

So what, you may ask, does the big guy have to do with investing? Not much, I’ll grant, but there is this: I believe the movie I saw last week corresponds to reality with just about the same level of fidelity as what I hear reported out of Washington today. While we can sometimes chuckle, it’s a sad state of affairs when the affairs of state are reduced to so much foolishness, dishonesty and absurdity, isn’t it?

If that isn’t bad enough, it’s doubly insulting that the disingenuous pontificating that we get from our elected officials, and the over-the-top screaming dialog the press somehow has the gall to label as reporting, is so obvious in its transparency. It seems as if they are not even trying to present believable information. It is wearing me down…can you tell?

And the problem is, of course, that it matters. I will admit, however, in this age of social media everything seems to matter. I am quite confident after hearing the recent hullabaloo over “Shaq” (jokingly) endorsing a “flat earth” belief that there are all too many that will take the leap from watching matinee monster movies to assuming there are dinosaurs and the like roaming the Pacific Islands.

I got up early to see the 7 AM monster movies on Saturday mornings when I was a kid. They switched off with Tarzan movies every few months or so as I recall. On rainy afternoons, the double-bill Creature Feature was just the thing to pass the dreary day. Unfortunately, my over-protective mom wouldn’t let me watch monster movies until I was in my 30s (ok, that’s a bit of an exaggeration); perhaps it was because I didn’t sleep the second half of my fifth year on earth after watching those flying monkeys steal Dorothy away. Full Disclosure: They still give me the creeps.

Now it’s the creatures’ features in Washing DC that are keeping me awake. When did the culture of Professional Wresting and Jerry Springer TV extend itself into our political discourse? I’m not sure when it happened, but happened it has.

Now it’s the creatures’ features in Washing DC that are keeping me awake. When did the culture of Professional Wresting and Jerry Springer TV extend itself into our political discourse? I’m not sure when it happened, but happened it has.

Okay, that’s probably enough venting on my part. Let’s get down to what matters to investors. At this writing, the probability of smooth passage of new health care legislation looks shaky at best. If this effort fails in March, it will likely cast doubt on the market’s confidence in the ability of the administration and the congress to cooperate, regardless of party affiliation. This, then, casts doubt on the ability of congress to pass meaningful tax relief this year, and at this point, faith in tax relief is the biggest driver for the stock market.

I believe we’ve seen a significant increase in the US equity markets since the November election. The DOW was a nominal 18,000 during the first week of November and hit an intraday high of 21,000 on March 16th. That’s a smoking 16.7% by my calculation. It’s also an indication that the new administration’s commitment to regulatory easing and the Federal Reserve’s projection for slow tightening are now priced into a market that was starved for hopeful signs from Washington for a long time. If we get tax relief, we will probably see some additional upside, but if we don’t, we will more than likely see a significant pullback.

This, as you might guess, leads me to the conclusion for my investing of “stay the course”. Neither a potential market surge’ nor a possible pullback in the latter half of 2017 have me planning a significant change to my long-term strategy. As I’ve told you, I am a long-term investor and I believe in holding good quality and growth over time. Steady as she goes, is where I’m living these days, even if the politicians and the markets aren’t.

March 2017

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.