Well, Happy New Year and a big “Bah Humbug” from the stock market indices. Like a certain former President once said: “I feel your pain.” Trust me, I really do. I unintentionally opened my retirement account statement just a few days before Christmas and ouch! It was not a jolly feeling, no… not in the least.

It comes at the end of a 2018 that was Dickensian in scope. For investors, January and late summer were the best of times –and the fourth quarter was the worst of times. Or, at least they felt like it. And please trust me, I am not being glib; the market declines have started to cause palpable angst among investors and retirees.

What is a bear market?

For some background — the unknown and mysterious “they” that define such terms as “bear” and “bull” markets suggest the following as the explanation:

A bear market begins when an index is 20% off its all-time or recent high. As I’m writing this, the DOW is about 15% off its high of early October 2018, the technology-heavy Nasdaq is right at the negative 20% mark, and the Russell 2000 (Small Cap US stocks) is down 25% from its high. Emerging markets are worse; it was just a dismal 2018 for them.

Another factor – the Fed

Another factor – the Fed

From experience, it is said, comes wisdom. How much wiser are we than a year ago? Maybe we should be satisfied with a few reminders. Perhaps the strongest for me is best summarized by what a more experienced advisor and mentor said to me about 20 years ago: “Don’t fight the Fed.”

Yes, it is true that when the Federal Reserve is determinedly raising interest rates to either ward off inflation or add arrows to the quiver for future recessionary periods, they give stocks a headwind that drags market performance downward. The trick that no one can master, however, is to forecast the Feds doggedness in these matters. For some more perspective, here’s an interesting link that gives some historical context for Fed movements.

Yikes! Things seem tame today compared to the late ‘70s and early ‘80s, don’t they? The years 2004 and 2005, and 2008 – 2009 weren’t walks in the park either, right?

Trade and tariff issues affect the markets, too

The trade/tariff issue is probably another significant contributor to the volatility in the markets. Tariffs stifle growth, and tariff wars are a disaster to economies… especially emerging ones. Uncertainty gives way to sudden optimism or pessimism in the markets depending upon the news of the day — or of the hour.

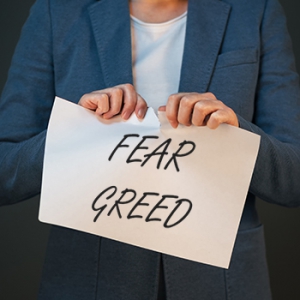

And optimism and pessimism are nice ways to talk about the biggest market drivers: fear and greed. Now, please, don’t be insulted – I am not accusing you of either vice. But, you can see both fear and greed at work in the herd mentality that drives the markets up and down hundreds — now one thousand plus — points a day.

Fear and greed can be a bad way to manage your investments

Fear and greed can be a bad way to manage your investments

So, after reviewing all this, what should you and I do for our investment approach in 2019? What conclusions can we come to?

I suggest one thing — to rid ourselves of those seductive emotions of fear and greed. One can replace them with a stalwart commitment to stay the courses we’ve plotted. Whether you are 18 or 81, or even 61 like a certain blogger you know and love, we (hopefully) have a carefully considered financial plan that is unique to our individual lives.

Assess, reassess, and, adjust your course when needed — but do not let fear or greed drive you, or your investment portfolio, where you do not want to go.

January 2019

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.