‘Tis the season. The question you might ask is, “The season for what?”

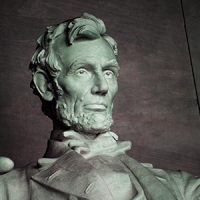

Late November is the season in America for giving thanks (go read Abraham Lincoln’s Thanksgiving Proclamations of 1863 and 1864. They will inspire and humble you, and give you a little historical perspective when you read today’s headlines. You can find them at alleninvestments.com under Resources.

Late November is the season in America for giving thanks (go read Abraham Lincoln’s Thanksgiving Proclamations of 1863 and 1864. They will inspire and humble you, and give you a little historical perspective when you read today’s headlines. You can find them at alleninvestments.com under Resources.

One reason we can be thankful in 2016 is, if for no other reason, the season for presidential campaign ads and debates is over for four years…well, at least for three.

By now you know the election results, but I’m writing to you the week before the election so I still can speculate upon the results. I’ll give you my predication and you can know instantly the quality of my prognostication skills. And you know, don’t you, how I caution against investing on a short-term basis? If you’re not sure, I’ll remind you that I call that speculating, not investing.

Well, here’s my speculation regarding the national elections: I think the Democratic candidate takes the White House; the Republicans keep the Senate by one or two seats, and the House of Representatives by about 35 to forty seats. This, mind you, isn’t what I hope does or doesn’t happen; it’s just what I am guessing by reading the tealeaves. And if it turns out I’m right (a rare occurrence, according to my children), it indicates we are in for another four years of gridlock, bickering and partisan-fueled investigations in Washington. The stock markets will likely respond with a resounding “Meh”.

If I’m completely wrong and the election results flip-flop from my prediction, I think we are in for four years of gridlock, bickering and partisan-fueled investigations in Washington, and the stock markets will likely respond with a resounding “Meh”.

If I’m completely wrong and the election results flip-flop from my prediction, I think we are in for four years of gridlock, bickering and partisan-fueled investigations in Washington, and the stock markets will likely respond with a resounding “Meh”.

One of the things the investment markets do care about is how governments here and in Europe will handle mounting debt. Any of us that manage a household budget know there are only two choices: spend less, and/or bring in more.

I think you will agree, simply on the face of the daily experience, that our Federal Government spending less is not likely in the foreseeable future. As to raising revenue, the debate in Washington will continue: will federal revenues rise with higher tax rates at the risk of stifling growth, or will they rise with reduced tax rates meant to encourage growth which may or may not offset the loss from lower rates? If you give me a day or two, I could provide separate convincing mathematical arguments ‘proving’ both cases; most people wouldn’t be swayed either way. Unfortunately, these issues have become emotional ones in our public discourse and there is no longer room for logical discussion and debate; hence: gridlock.

So this season, please do give thanks, for your life, your family, your daily bread, the great land in which we live, … and for gridlock … else those obstreperous ninnies inside the beltway come up with some other great plan to lead us all towards perdition.

We’ll talk soon…